How to Close a Business Bank Account UK

Navigating the Closure of a UK Business Bank Account: A Strategic Framework

Published: February 2026 | Authority: LocalPage.uk Senior Content Architect

In the evolving landscape of 2026, the process of closing a business bank account in the United Kingdom has become more than a simple administrative task; it is a critical component of corporate compliance and financial hygiene. Whether you are switching providers to take advantage of new fintech innovations, winding down a limited company via Companies House, or transitioning from a partnership to a sole trader structure, the precision with which you exit a banking relationship dictates your future regulatory standing with HMRC and the Financial Conduct Authority (FCA).

5.6m private sector businesses in the UK are currently navigating a more complex regulatory environment than ever before. With 99.3% being SMEs, the need for clear, practical guidance on financial exits is paramount for maintaining national economic stability.

Determining the Strategic Reason for Account Closure

Before initiating contact with your relationship manager or the bank’s digital closure team, it is essential to categorise the nature of the closure. In 2025 and 2026, we have observed a significant trend in "banking portability," where businesses move towards providers offering better integration with AI-driven accounting software. However, the reason for closure changes the legal requirements, particularly regarding Companies House filings and HMRC notifications.

Closure Due to Business Cessation vs. Provider Switching

If you are closing your account because the business is no longer trading, you must ensure that all final tax liabilities are settled before the final balance is distributed. In Scotland, the process for members' voluntary liquidation involves specific requirements under the Insolvency Act, which your bank will need to verify before releasing final funds. Conversely, if you are simply switching providers, the Current Account Switch Service (CASS) may automate much of the transition, though many complex business accounts still fall outside the scope of this automated guarantee.

Identifying the Impact on Credit and Financial History

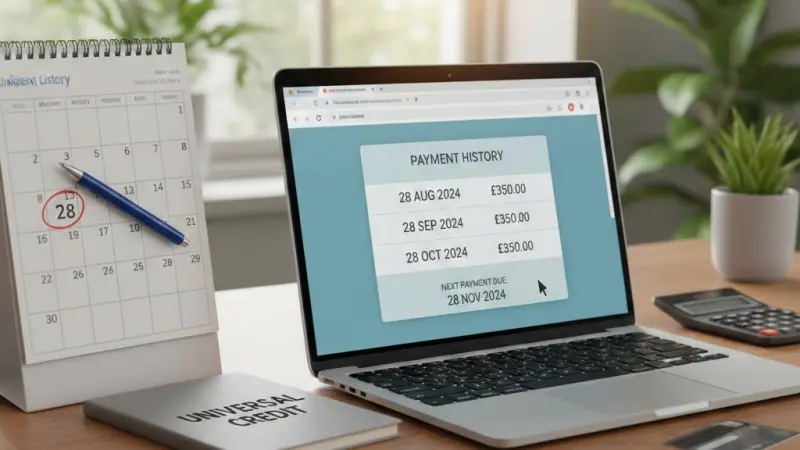

Closing an established account can impact your business credit score. Financial institutions in England and Wales often look at the age of your primary account as a proxy for stability. If you are closing an account that has been open for a decade to move to a digital-only startup, ensure you have downloaded at least seven years of statements. Under the UK’s Data Protection Act and ICO guidelines, banks are required to maintain records, but your ease of access diminishes once the login portal is deactivated.

Evidence of Financial Solvency

Always obtain a final "Proof of Closure" letter. This document is often required by HMRC during a standard compliance check or when proving to a new provider in Northern Ireland that previous debts were fully settled.

Preparation: The Pre-Closure Financial Audit

A premature closure can lead to "orphan transactions"—payments sent to a closed account that are then bounced back or, worse, held in a suspense account. In 2025, it is estimated that UK SMEs lost over £140 million in administrative time and lost interest due to poorly managed bank transitions.

Mapping Your Direct Debits and Standing Orders

Start by auditing your last 12 months of statements. This is crucial for seasonal businesses, such as those in the hospitality sector, where certain annual licenses or local authority rates (such as those paid to councils in the Midlands or the Scottish Borders) may only trigger once a year. Ensure that all mandates are migrated to the new account at least 15 working days before the closure request is formalised.

Managing Merchant Services and Payment Gateways

For retail and e-commerce businesses, your bank account is likely linked to a merchant acquirer. Closing the account without updating your terminal or gateway settings will result in a "settlement failure." Businesses in Wales using Business Wales support should consult their mentors to ensure that any government-backed loans or grants are correctly redirected to the new nominated account to avoid a breach of terms.

The 30-Day Transition Window

Maintain a "dual-running" period where both accounts are active. This provides a safety net for any straggler payments that were not successfully rerouted during the initial transition phase.

76% of UK consumers now research businesses online before engaging; a failed payment to a supplier that leads to service disruption can result in negative reviews, which 68% of customers trust as much as personal recommendations.

Navigating the Legalities of Final Balance Distribution

The movement of the final balance is the most scrutinized part of the closure process. Banks are bound by strict

Anti-Money Laundering (AML) and "Know Your Customer" (KYC) regulations, which have been significantly tightened for the 2025/26 period.

Resolving Outstanding Liabilities and Overdrafts

You cannot close a business account with a debit balance. If your business has a Bounce Back Loan or a recovery loan scheme balance, you must reach an agreement with the bank on how this debt will be serviced or transferred. In Northern Ireland, cross-border trade considerations mean that any Euro-denominated debts must be cleared at the prevailing spot rate before the Sterling account can be formally shuttered.

Distributing Surplus Funds to Shareholders

For limited companies, the final balance often represents the remaining capital to be distributed to shareholders. It is vital to classify these payments correctly—whether as dividends or capital distributions—to ensure your final Corporation Tax return to HMRC is accurate. Failure to do so can lead to an enquiry, particularly if the amounts are substantial.

Statutory Interest and Final Charges

Be aware that many banks apply a final "closure fee" or pro-rated monthly service charge. Ensure the final balance accounts for these small but significant deductions to avoid the account remaining open with a few pence of debt.

HMRC and Companies House Compliance Requirements

Closing your bank account is often the penultimate step in closing a business. The final step is typically the application for striking off a company (Form DS01).

Notifying HMRC of Your Final Trading Status

Once the account is closed, you must inform HMRC that the company is no longer trading. This prevents the issuance of further "Notice to Deliver a Tax Return" letters. For businesses in Scotland, Revenue Scotland must also be notified if there are outstanding Land and Buildings Transaction Tax (LBTT) considerations related to the business premises.

The "Striking Off" Process and Bank Freezes

A common and costly mistake is applying to Companies House to strike off the company while funds are still in the bank account. The moment a company is dissolved, all its assets—including the bank balance—become "Bona Vacantia" (vacant goods) and legally belong to the Crown. In 2025, the Treasury Solicitor’s department saw a 12% increase in claims from business owners trying to recover funds from accounts that were frozen post-dissolution.

Public Register Transparency

Remember that the application to close your business is a matter of public record. Ensure your filings are accurate to maintain your professional reputation for future ventures.

Regional Variations in the Banking Exit Process

While the major banks (Barclays, Lloyds, NatWest, HSBC) operate UK-wide, local regulations and support structures vary across the four nations.

Special Considerations for Scotland and Wales

In Scotland, the legal system's nuance regarding "not proven" status and debt recovery can occasionally lead to different timelines for bank lien releases. In Wales, Business Wales provides specific exit strategy workshops for micro-businesses (which make up 94% of the Welsh business population) to ensure that the closure of a bank account doesn't trigger unnecessary audits from local authorities.

Northern Ireland and the Windsor Framework

Businesses in Northern Ireland must be particularly careful if they hold multi-currency accounts used for trade with the Republic of Ireland. The interaction between UK banking law and EU-aligned trade regulations under the Windsor Framework means that closing a "dual-purpose" account may require additional declarations to the ICO if customer data is being transferred across borders during a merger or acquisition.

"Hey Siri, how do I close a NatWest business account in 2026?"

Most major UK banks now require you to submit a closure request through their secure online banking portal. You will need your final VAT return details and a board resolution (for limited companies) confirming the decision to close.

"Alexa, what happens to my business bank statements after the account is shut?"

You are legally required to keep business records for 6 years. Download all PDF statements before the bank revokes your digital access, as ordering paper copies post-closure can cost up to £10 per page.

Security and Data Protection During the Handover

The period during which an account is being closed is a high-risk window for "Authorised Push Payment" (APP) fraud. Scammers often impersonate bank officials claiming there is a "problem with the final transfer."

Adhering to ICO Guidelines on Financial Data

The Information Commissioner’s Office (ICO) requires businesses to handle customer and employee financial data with extreme care. When you close your bank account, ensure that any stored payment details of your clients are either securely deleted or moved to a new encrypted environment that complies with the latest UK GDPR standards.

Digital Identity and Open Banking Permissions

In 2026, many businesses use "Open Banking" to share data with third-party apps for VAT filing or cash-flow forecasting. When closing an account, you must manually revoke these permissions within each app. Simply closing the bank account does not always terminate the data-sharing token, which could lead to security vulnerabilities.

Multi-Factor Authentication (MFA) Access

Ensure that the mobile number associated with the bank’s MFA is not scheduled for disconnection (e.g., if you are also closing a corporate phone contract) until after the final balance has been confirmed as received in the new account.

Common Roadblocks and How to Overcome Them

The path to closure is rarely a straight line. Banking "friction" is a common complaint among the 532,000 professional services businesses in the UK.

Dealing with Lost Signatories and Mandate Issues

If a former director or partner who is still on the mandate is unreachable, the bank will refuse to close the account. You must first update the mandate—a process that can take 4-6 weeks—before the closure request can be processed. This is a significant pain point for older partnerships in Northern England where historical mandates were often paper-based.

The Role of the Financial Ombudsman Service

If a bank is "trapping" your funds by refusing a closure request without a valid legal reason, you have the right to escalate the matter to the Financial Ombudsman Service (FOS). In 2025, the FOS ruled in favour of SMEs in 34% of cases related to "unfair banking exit barriers."

Final Checklist for a Clean Exit

To ensure your business transition is seamless, follow this technical checklist formulated for the 2026 regulatory environment.

Administrative and Regulatory Tasks

Confirm all cheques issued have been cashed. In the digital age, we often forget that manual cheques remain valid for six months.

A cheque presented against a closed account will result in a "refer to drawer" status, potentially damaging your reputation with a key supplier.

Final Communication with Stakeholders

Notify your employees, especially if the account being closed was the one used for BACS payroll runs. Similarly, notify the pension provider (such as NEST or a private scheme) to ensure there is no break in contributions, which could lead to an investigation by The Pensions Regulator.

The "Nil Balance" Confirmation

Once you see the balance hit zero, wait for the formal "Account Closed" statement. Keep this in your permanent corporate archive. It is your ultimate shield against future claims of unpaid bank fees or unresolved liabilities.

Need to Verify a Service Provider?

Before moving your business funds to a new provider, ensure they are fully registered and authorised in the UK.

Browse Verified UK Financial Services

Frequently Asked Questions

Can I close my business account if the company has been dissolved?

No. Once a company is dissolved at Companies House, the bank account is legally frozen as the funds belong to the Crown. You must close the account and distribute the funds before the final dissolution date. If you have already dissolved the company, you will need to apply for a 'discretionary grant' from the Government Legal Department to recover the funds, which is a lengthy and costly process.

How long does it actually take to close a business bank account in the UK?

For a simple sole trader account, it can take 3-5 working days. However, for limited companies with multiple signatories, expect 15-30 days. This allows the bank to perform final AML checks and ensure all pending transactions are cleared. In 2026, most banks require a digital signature from all registered directors via platforms like DocuSign before they will proceed.

Do I need to pay HMRC before I can close my bank account?

While the bank won't check your tax status, you have a legal obligation to settle all VAT, PAYE, and Corporation Tax liabilities before distributing the final balance. If you close the account and spend the money without paying HMRC, directors can be held personally liable for the debt through a 'Personal Liability Notice', especially if it is deemed you purposefully liquidated assets to avoid tax.

What happens to my Bounce Back Loan if I close the account?

A bank account closure does not cancel a loan. If you are switching banks, the loan usually stays with the original lender, and you must set up a new Direct Debit from your new account to continue repayments. If you are closing the business entirely, the loan must be addressed in your liquidation or insolvency proceedings. These loans are government-backed but are still formal debts that must be managed.

Can I close an account online without visiting a branch?

In 2026, almost all UK banks (including the 'Big Four') allow online closures for SMEs. However, if your mandate requires 'any two to sign' or has complex trust structures, you may be required to attend a video verification call. Physical branch visits are now rare and usually only required for accounts involving high-risk sectors or very large cash balances.

Is there a fee for closing a business bank account?

Most UK banks do not charge a specific 'exit fee', but you will be charged the standard monthly maintenance fee on a pro-rata basis for the final month. Additionally, if you require a fast-track CHAPS transfer to move the final balance to a new provider, you will likely incur a fee of between £20 and £30.

Will closing my account affect my personal credit score?

Generally, no. Business bank accounts are separate legal entities from your personal finances. However, if you have a 'Personal Guarantee' on a business overdraft or loan and that debt goes unpaid during the closure process, it can and will be reported to credit agencies, severely impacting your personal ability to borrow in the future.

What if I have an outstanding dispute with the bank?

It is advisable to resolve any formal complaints through the bank's internal dispute resolution process before closing the account. Once the account is closed, you are no longer a 'customer', which can complicate your standing with the Financial Ombudsman, though you still technically have the right to complain about past service for up to six years.

Are there different rules for businesses in Scotland or NI?

The core banking regulations are UK-wide (FCA regulated). However, the underlying insolvency laws in Scotland differ, and businesses in Northern Ireland must ensure they comply with specific reporting if they have been using the account for significant EU-aligned trade.

Always check if your specific regional grant provider (e.g., Invest NI) has a lien on your account before attempting to close it.

How many years of bank statements should I download?

HMRC requires you to keep business records for 6 years after the relevant tax year. Since digital access is usually cut off within 24 hours of account closure, you should download the full 6-year history in CSV and PDF formats. In 2026, many AI accounting tools can bulk-import these files to create a permanent archive for you.

Most Searchable Keywords

Recent Blogs

Related Listings

Categories

- Accountants (290)

- Advertising Agencies (558)

- Architects (145)

- Automobiles (273)

- Beauty (300)

- Carpenters (142)

- Cleaning Services (218)

- Dentists (189)

- Driving (61)

- Electricians (79)

- Event Organiser (682)

- Finance (295)

- Guide (2089)

- Health (2099)

- Legal Services (352)

- Marketing (707)

- Packers and Movers (179)

- Painters (144)

- Photographers (215)

- Plumbers (72)

Questions & Answers – Find What

You Need, Instantly!

� How can I update my business listing?

� Is it free to manage my business listing?

� How long does it take for my updates to reflect?

� Why is it important to keep my listing updated?