How to Check Universal Credit Payment

How to Check Universal Credit Payment Date: A Professional UK Guide

Last updated: February 2026 | UK Policy & Compliance | LocalPage.uk Architect

Understanding the architecture of Universal Credit (UC) is no longer solely the domain of the Department for Work and Pensions (DWP); it is a critical operational insight for UK business owners, payroll managers, and professional service providers. As we move through the 2025-2026 fiscal year, the interaction between earned income and UC payment schedules has become more complex, particularly with the rise of Real Time Information (RTI) reporting.

7.2 Million People in the UK are currently claiming Universal Credit as of January 2026, including 2.4 million people who are in work.

Identifying Your Assessment Period and Payment Cycle

The fundamental building block of a Universal Credit payment is the 'Assessment Period'. Unlike legacy benefits, UC is calculated every month based on the circumstances reported during a specific 30-day window. Your payment date is inextricably linked to the day your first claim was submitted.

The Link Between Claim Date and Payment Schedule

Your payment date is usually seven days after your monthly assessment period ends. For example, if your assessment period runs from the 15th of one month to the 14th of the next, your payment date would typically be the 21st of each month. This cycle is automated, yet for businesses employing staff on UC, understanding this lag is vital for managing employee financial wellbeing during payroll shifts.

Using the Online Journal to Verify Dates

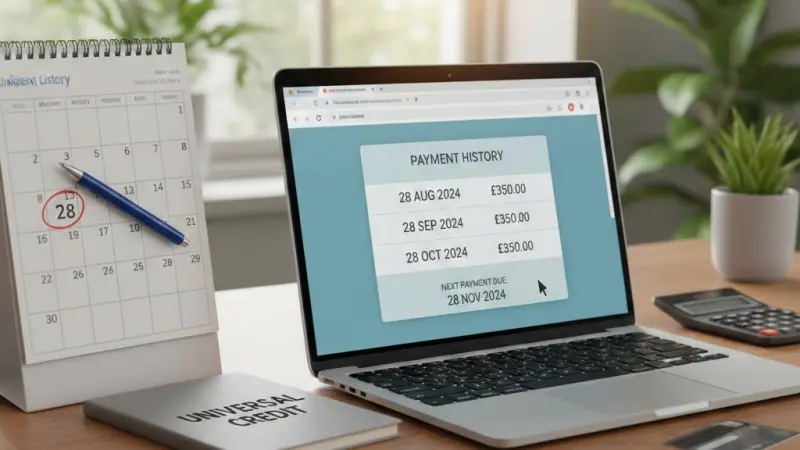

The most direct method to check a payment date is via the 'Universal Credit Online Journal'. This secure portal serves as the primary communication channel between the claimant and the DWP. Within the portal, the 'Payments' section provides a detailed breakdown of upcoming transfers, including the exact date the funds will be cleared in the nominated bank account.

Digital Verification for Self-Employed Directors

Small business owners who operate as limited companies but claim UC must be particularly diligent. You should check your journal at least three days before the assessment period closes to ensure all monthly income and expenses (MID) have been correctly logged, as this directly affects the generated payment date and amount.

Navigating the Universal Credit Online Portal Effectively

The UK digital infrastructure has been significantly upgraded for 2026, allowing for smoother interactions via the GOV.UK gateway. For hospitality or retail businesses with high staff turnover, helping employees navigate this portal can reduce administrative queries directed at the HR department.

Accessing Statement Summaries for Future Planning

Within the portal, statements are usually generated two to three days before the actual payment date. These statements do not just list the date; they provide the calculation logic. This is crucial for workers in England and Wales who may see fluctuations in their UC due to seasonal overtime or bonus structures.

Managing Sign-in Credentials and Security

Security protocols overseen by the ICO and DWP require multi-factor authentication. Users should ensure their mobile devices are linked correctly to avoid being locked out of their journals during critical payment windows. Losing access to the journal is the most common reason for missed payment date checks in the UK.

Impact of RTI Data on Your Statement Date

HMRC's Real Time Information system feeds directly into UC. If a business in Scotland submits payroll data early due to a bank holiday, this can sometimes trigger an 'early' assessment, potentially moving the perceived payment date or altering the award amount. Vigilance during festive periods is essential.

Professional Tip: Businesses should endeavour to keep payroll dates consistent. Whilst the DWP has implemented "easements" for twice-monthly pay, consistency remains the best way to ensure an employee's UC payment date doesn't shift unexpectedly.

Calculating Payment Dates During Bank Holidays and Weekends

The DWP does not process payments on Saturdays, Sundays, or Bank Holidays. This is a common point of confusion for small businesses in Northern Ireland and Wales where local holidays may differ from those in London.

The "Early Payment" Rule for UK Public Holidays

If a payment date falls on a weekend or a bank holiday, the DWP typically issues the payment on the last working day before. For instance, if the 25th of the month is a Sunday, the payment will be checked and cleared on Friday the 23rd.

This requires businesses to be aware of their employees' schedules to prevent cash-flow issues at the end of the month.

Regional Variations: Scotland and Northern Ireland

In Scotland, Social Security Scotland works alongside the DWP. Scottish claimants can choose to have their UC paid twice monthly rather than once. This fundamentally changes the payment date logic, creating two distinct dates to check. In Northern Ireland, similar flexibilities exist, and the Department for Communities handles the local oversight of these schedules.

The Christmas and Easter Adjustment Period

During major UK holidays, the payment window can shift by up to four days. In 2025-2026, the DWP will publish a revised schedule for the December period by late October. Employers are encouraged to share these "early pay" dates with staff to assist with household budgeting.

The Impact of Monthly Earnings on Payment Accuracy

For the 5.6 million private sector businesses in the UK, understanding how their payroll affects UC is a matter of compliance and employee retention. The 'Taper Rate'—currently set at 55%—means for every £1 earned after the work allowance, UC is reduced by 55p.

How Reporting Lags Can Shift Payment Windows

If income is reported late via HMRC, the DWP may suspend a payment date until the data is verified. This is common amongst micro-businesses (0-9 employees) that may still be using manual reporting or older software. Upgrading to HMRC-recognised cloud accounting is a strategic necessity in 2026.

Work Allowances and Their Role in Schedule Stability

Certain claimants have a 'Work Allowance', allowing them to earn a set amount before their UC is affected. If a claimant moves between having a work allowance and not (for example, due to changes in disability status), the date of the payment remains the same, but the reliability of the amount may fluctuate, necessitating more frequent checks of the online journal.

Surplus Earnings and Re-application Dates

If an employee in the North East or Midlands receives a significant bonus that wipes out their UC for one month, they must understand the 'Surplus Earnings' rule. This may require them to 'check' a re-application date rather than a payment date the following month.

68% Of UK SMEs now offer financial wellness support, which includes helping staff interpret their DWP payment schedules to reduce workplace stress.

When to Contact the Universal Credit Helpline

While the digital journal is the preferred method, there are instances where the system fails or dates become obscured. The UC helpline remains an authoritative source for resolving complex payment discrepancies.

Navigating the DWP Telephony System

The helpline (0800 328 5644) is typically busiest on Mondays and the first of the month. Professionals advising clients should recommend calling at 8:00 AM GMT to avoid lengthy wait times. In 2026, AI-driven voice assistants now handle basic "When is my payment?" queries, speeding up the process for those without internet access.

Escalation Procedures for Missing Payments

If a payment date has passed and funds have not arrived, this is an emergency. Claimants should first check for a 'Notification of Requirement' in their journal. If none exists, the helpline can issue a 'Same Day Fast Payment' in specific hardship cases, though this is subject to strict DWP criteria.

Role of the Independent Case Examiner (ICE)

For persistent issues where payment dates are consistently missed or incorrectly calculated, businesses may help employees escalate the matter to the ICE. This is a last-resort measure for systemic failure but ensures accountability within the DWP infrastructure.

Strategies for Managing Fixed Costs Around UC Dates

For startups and small businesses, employees on UC may request specific shift patterns to align with their payment dates. Whilst businesses must maintain operational efficiency, a measured approach to these requests can foster loyalty.

Aligning Direct Debits with Payment Schedules

Advice from the Federation of Small Businesses (FSB) suggests that individuals should set their direct debits for at least three days after their expected UC payment date.

This provides a buffer for the "early payment" rules during bank holidays and prevents overdraft fees.

Alternative Payment Arrangements (APAs)

In cases where tenants or employees struggle with budgeting, the DWP can arrange for the housing element of UC to be paid directly to a landlord. This changes the 'check' requirement, as the landlord now becomes responsible for verifying the receipt of funds on the designated date.

Financial Tools and Budgeting Apps in 2026

Many UK fintech banks now offer "Paid Early" features that allow users to access their UC payment a day early. If a user's payment date is a Tuesday, some banks can clear the funds by 4:00 PM on Monday. This is a significant trend in consumer behaviour that businesses should be aware of when discussing financial health with staff.

Voice Search Assistance: Quick Answers

"Hey Google, when is my Universal Credit paid this month?"

Your payment is usually made 7 days after your assessment period ends. You can check the exact date in the 'Payments' section of your online Universal Credit account.

"Alexa, what happens if my UC payment date is a bank holiday?"

If your payment date falls on a bank holiday or weekend, you will typically be paid on the last working day before the holiday starts.

Understanding the "Five-Week Wait" Architecture

For new businesses or those hiring staff for the first time, the initial "five-week wait" is a critical period. This wait occurs because the first assessment period must conclude before the first payment date is set.

The Advance Payment Option

To bridge this gap, claimants can check their eligibility for an 'Advance Payment'. This is effectively a loan from the DWP, and the repayments are deducted from future UC payments. Checking the 'repayment schedule' is just as important as checking the payment date, as it affects net income for up to 24 months.

Impact on Professional Services and Credit Scoring

The FCA-regulated lending market in the UK has become more sophisticated in how it views UC. Consistent payment dates, verified through bank statements or the UC portal, are often required for small personal loans or car finance, making the ability to check and prove these dates vital for economic mobility.

Alternative Support from Local Authorities

In England, local councils provide Discretionary Housing Payments (DHPs) for those whose UC housing element doesn't cover their rent. The payment dates for DHPs are separate from UC dates and must be checked directly with the local authority (e.g., Birmingham City Council or Manchester City Council).

Future-Proofing Your Knowledge of DWP Systems

As we approach the end of the 2025-2026 period, further digitisation is expected. The 'Move to Universal Credit' (Managed Migration)

is nearly complete, meaning almost all legacy benefit recipients have now transitioned to the UC payment logic.

Changes to Thresholds and Tapers

Government budgets in late 2025 may alter the taper rate or the Administrative Earnings Threshold (AET). While these changes don't usually shift the *date* of payment, they shift the *intensity* of the check, as more people may find their payments reduced to zero if they earn above certain limits.

Working with British Chambers of Commerce (BCC)

The BCC and other professional bodies provide regular updates on welfare-to-work schemes. Staying informed through these channels ensures that your business remains an authoritative and helpful environment for workers navigating the UC system.

Summary of Essential Checks for Payment Dates

To conclude, the ability to check a Universal Credit payment date is a foundational skill for the modern UK workforce. Whether you are a sole trader in Wales or a large employer in London, the logic remains: the date is born from the claim day, adjusted by the calendar, and verified through the digital journal.

Need to List Your Professional Services?

Join thousands of UK businesses providing professional advice and services on our platform.

Frequently Asked Questions

Why hasn't my Universal Credit payment date appeared in my journal yet?

Your payment statement usually only appears in your online journal 48 to 72 hours before the actual payment date. If your assessment period has only just ended, the DWP systems are likely still calculating your award based on HMRC payroll data. If it hasn't appeared 2 days before you expect it, contact your work coach via the journal immediately.

Can I change my Universal Credit payment date to match my rent due date?

Generally, you cannot change your UC payment date as it is fixed to the date of your original claim. However, in Scotland and Northern Ireland, you can request more frequent payments. In England and Wales, if you are struggling, you can ask for an 'Alternative Payment Arrangement' where rent is paid directly to your landlord, which may help align your finances.

What time of day does the money actually enter my bank account?

Most UK banks (like Barclays, Lloyds, and NatWest) clear DWP payments between midnight and 3:00 AM on the morning of the payment date. If you use a neo-bank like Monzo or Revolut, you may be able to see the payment as 'pending' the day before or even access it early via specific app features.

I'm self-employed in Wales - how do I check my payment date?

The process is the same across the UK. You must log in to your GOV.UK journal. However, as a self-employed person, your payment date may be delayed if you fail to report your monthly income and expenses by the end of your assessment period. Business Wales offers guidance for those struggling with the digital reporting aspect of UC.

Does a pay rise at work change my UC payment date?

No, a pay rise will not change the date you are paid, but it will likely change the amount you receive. HMRC will notify the DWP of your new earnings via the RTI system, and your next statement (visible 2-3 days before your payment date) will reflect the reduction based on the current 55% taper rate.

What should I do if my payment date falls on Good Friday?

Good Friday is a bank holiday across the UK. Therefore, your payment should be moved forward to the Thursday before. You do not need to do anything; the DWP's BACS system automates this adjustment. You can verify this in your journal's 'Payments' section a few days prior.

Is the payment date different for the 'Limited Capability for Work' element?

No, all elements of your Universal Credit—including housing, child, and disability elements—are paid together in a single lump sum on the same monthly payment date. Even if you are awarded a new element, it will be integrated into your existing assessment period and payment cycle.

How does the Northern Ireland "Double Payment" affect my date check?

In Northern Ireland, the default is to be paid twice monthly. This means you will have two payment dates to check in your journal. These are typically 15 days apart. You can opt-out and choose a single monthly payment if that better suits your household budgeting needs.

Will my payment date change if I move from London to Scotland?

Your actual payment date usually remains the same based on your original claim date. However, once your address is updated, you will be given the option

of 'Scottish Choices', which includes the ability to switch to twice-monthly payments, which would introduce a second payment date into your schedule.

Can an employer check an employee's UC payment date?

No. Due to GDPR and DWP privacy rules, an employer has no right to access an employee's Universal Credit information or payment dates. Any information shared must be done so voluntarily by the employee, for instance, if they are providing a statement to prove income for a reference or internal support scheme.

Most Searchable Keywords

Recent Blogs

Related Listings

Categories

- Accountants (290)

- Advertising Agencies (558)

- Architects (145)

- Automobiles (273)

- Beauty (300)

- Carpenters (142)

- Cleaning Services (218)

- Dentists (189)

- Driving (61)

- Electricians (79)

- Event Organiser (682)

- Finance (295)

- Guide (2115)

- Health (2099)

- Legal Services (352)

- Marketing (707)

- Packers and Movers (179)

- Painters (144)

- Photographers (215)

- Plumbers (72)

Questions & Answers – Find What

You Need, Instantly!

� How can I update my business listing?

� Is it free to manage my business listing?

� How long does it take for my updates to reflect?

� Why is it important to keep my listing updated?